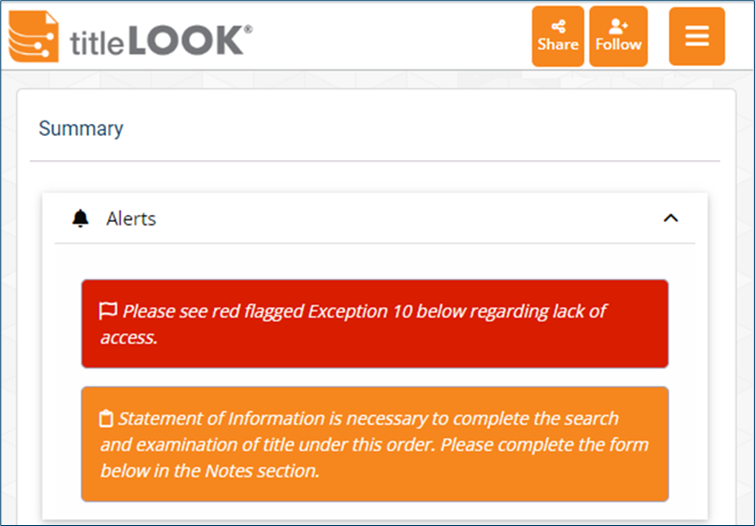

BANGOR, Maine – August 23, 2022 – – titleLOOK® announces a new quality control (QC) feature that instantly analyzes all title reports for specific phrases, exception types and customized clearance scores. The feature can also target sub-sections such as legal descriptions, notes or requirements. The alerts are delivered on-screen via titleLOOK reports, through cover pages of PDF/DOC reports, or via real-time email, text and API integration.

“Many clients want to check for specific phrases that get overlooked during the review stage. We solved for that and went steps further by adding curative knowledge to the monitoring as well. The result is a first-of-its-kind alerting service for each report produced by an underwriter or agent.” said Bill Boyington, CEO of Mainspring Services, the creators of titleLOOK.

These alerts are grouped into three main categories: Analysis, Audit, and Action.

Analysis Alerts are produced when specific criteria are present in the report. Client administrators set rules to search the entire report or sub-sections to identify individual exceptions, flags, tags, legal phrases, effort scores, etc. Examples include No Mortgages Found, Lack of Legal Access and Construction/Loss of Priority.

Audit Alerts are activated when specific criteria are not present in the report. This identifies reports produced outside of underwriting guidelines, which can lead managers to increase staff training, or act as a signal that claims may arise from insufficient legal language. This category also monitors criteria in search documents such as plat maps and CC&Rs, which often require government and/or underwriter disclaimers. Examples include CC&R language in California and survey images in North Carolina.

Action Alerts are created to guide users through the curative action required for given exceptions or requirements. This clearance knowledge – including the steps to follow, the blank forms to complete and the parties to contact – is made available via titleLOOK reports. Examples include FinCen Reports, Statement of Information, Affidavits of Non-Production, Uninsured Deed and Certification of Trust.

“This feature is immediately available to clients in all 50 states and is the first in our series of Underwriting 2.0 releases scheduled for the remainder of 2022. This release showcases the deep industry knowledge that our company is creating solutions from. Underwriting 2.0 is just getting started.” Boyington concluded.

The next titleLOOK release will focus on the management and version history of the overall underwriting language used by title underwriters and agents. Throughout the industry, this language is usually managed with multiple spreadsheets and then siloed into a title production system. titleLOOK aims to make that language manageable, actionable, and exchangeable between underwriter and agent.